INTRODUCING one of the world’s first

INSTITUTIONAL-GRADE

DIGITAL ASSETS

“Multi-SMA” Funds

Targeting Optimal Risk-Adjusted Returns,

Off-Exchange Custody, 24/7 Visibility for

Investors & Led by an Institutional Grade Team.

Review Our Performance Here:

This Is For Institutional Investors Who Are Looking for …

Exposure to the best performing asset class since 2009,

with lower potential risk & volatility*

DIGITAL ASSETS DONE DIFFERENTLY

- 5+ sharpe ratio

- Invest USD, BTC or ETH

- Yield achieved through inefficiency and volatility of digital assets vs purely direction

LIQUID, LOW CORRELATION ASSET CLASS

- Low correlation to traditional assets

- Monthly liquidity (after 6 month lock-up)

- Fund of funds model to reduce potential risk

CONSISTENT

RISK-ADJUSTED RETURNS*

- 15%-20% net target in non-bull years

- 75%-100%+ target net returns across

- 4 year cycle

- Pro-forma portfolio return: 190.24% since 1/1/19

- Counterparty Risk**: Only -1.54% annual average impact across last 5 years

*Pro forma performance, representing the average annualized performance from January 2019 through 2022, net of all fees, for the portfolio of underlying funds that Amphibian Fund intends to be invested in beginning on July 1 2022, if the same portfolio had been fully invested as of January 2019 with no rebalancing. Please note each fund that we went live at different times. Their numbers have been included from their go-live date. Slide 38 breaks down how our pro-forma calculations work ** Only one major counterparty ‘exchange’ event impacted our underlying funds by more than 3% total AUM in the last 5 years. Avoided all others. That was with FTX and approx 4.5%-6% impact on our USD & ETH fund. This breaks down to 8.5% exposure on USD, current bids on secondary markets and potential forecasts indicate a likelihood to recover 30c-50c on the dollar. This translates to 4.5%-6% potential impact). Outside of this, we had one other event from an underlying fund with 2.7% portfolio drawdown. This translates to approximately 1.54% average counterparty risk across the last 5 years. Our max portfolio strategy drawdown monthly target is < 1.5%, our max counterparty drawdown target is less than one year of yield target with -9.9%.

We Built a new product for Institutional investors to take advantage of this next cycle

YTD Performance*

Estimated YTD Returns for our USD Alpha Fund as of 9/30/24

Assets Under Management

Across our Fund of Funds and Institutional funds

GPs & Team Members

Across our various funds

gps & team

members

Review our Performance Here:

Built on the Success of

Our Amphibian Capital USD Alpha Fund

252.22% Amphibian vs. 80.54% Dow Jones

VS.

Dow Jones: 22.34%

VS.

Dow Jones: 7.25%

VS.

Dow Jones: 18.73%

VS.

Dow Jones: -8.78%

VS.

Dow Jones: 13.70%

VS.

Dow Jones: 11.74%

*Pro forma performance, representing the average annualized performance from January 2019 through July 2022, net of all fees, for the portfolio of underlying funds that Amphibian Fund invested in beginning on July 1 2022, if the same portfolio had been fully invested as of January 2019 with no rebalancing. Please note each fund was added to the portfolio at a different time, and beginning on July 1, 2022 actual net fund performance is included. All underlying fund performance has been included from the date each fund was added to the portfolio.

**This includes writing off 9% of FTX exposure to 0 (we anticipate given $7.3B of assets have been recovered by FTX- a large amount of this 9% could be recovered. This will go back into the fund as claims are sold by underlying funds and/or write-ups of underlying side pockets occur).

Pro-Forma Portfolio

for Amphibian Dunamis Capital

189.12% ADC vs. 41.75% Dow Jones

2021

VS.

Dow Jones: 18.73%

2022

VS.

Dow Jones: -8.78%

2023

VS.

Dow Jones: 13.70%

2024 YTD

VS.

Dow Jones: 5.01%

*Pro forma performance, representing the average annualized performance from January 2019 through July 2022, net of all fees, for the portfolio of underlying funds that Amphibian Fund invested in beginning on July 1 2022, if the same portfolio had been fully invested as of January 2019 with no rebalancing. Please note each fund was added to the portfolio at a different time, and beginning on July 1, 2022 actual net fund performance is included. All underlying fund performance has been included from the date each fund was added to the portfolio.

**This includes writing off 9% of FTX exposure to 0 (we anticipate given $7.3B of assets have been recovered by FTX- a large amount of this 9% could be recovered. This will go back into the fund as claims are sold by underlying funds and/or write-ups of underlying side pockets occur).

***Best projected estimate for August as of 8/23/24.

Where Power Meets Adaptability

Our Institutional fund is creating a new type of model for Digital Assets

- Return Profile

For Investors Targeting t-bill yield + Market-Neutral Digital Assets yield

- Asset Class

Digital Assets exposure with uncorrelated returns to other assets classes

- Risk Profile

Lower counterparty, cybersecurity and tail risk

- Team

Managed by CIO and Chief Risk Officer - ex HSBC - with 24/7 assets visibility

Amphibian Dunamis Capital

Institutional Fund Thesis…

TARGETING NET T-BILL YIELD + DIGITAL ASSET MARKET-NEUTRAL YIELD,

WITHOUT MAJOR DRAWDOWN OR COUNTERPARTY RISK

5+ sharpe*

Targeting a more consistent quarterly return than stocks,

real estate, precious metals.

< 0.15 correlation* to stocks and BTC

Uncorrelated to most assets

Max Monthly Drawdown Target -1.5%

With our high sharpe, low drawdown strategies we aim to minimize volatile returns

Monthly liquidity

Ability to liquidate assets with 30 days notice

Multi-Asset Class

Can invest USD, BTC or ETH

24/7 Visibility

See returns, portfolio and potential risks anytime through our EdgeFolio software

Real-Time LIVE dashboard

Investors can login to dashboard and view positions/accounts

and returns LIVE anytime (in progress)

Institutional Grade Risk Management

10-15+ Funds all through Swiss Bank partnership and our SMA accounts. No counterparty risk, low cyber security risk (only daily pnl or settlement amount). Stringent risk mgmt principles to monitor 24/7 and manage risk limits by Former COO Equities Americas of HSBC and $200M Crypto Quant Firm (in process)

Swiss Bank Custodian

Protects the downside with custody in escrow, while assets are generating t-bill yield (less bank fees) and mirrored onto the exchange for trading (testing begins q4/q1)

Capacity

We believe our product has between $750M-$1B in capacity without major market growth or significantly impacting

current strategies.

Review our Performance Here:

This Institutional Fund Will Be Managed By

Amphibian Capital & Dunamis Trading

The Largest Market Neutral Crypto Fund in 2021

Dunamis managed $250M+ aum at the end of ‘21 and returned investors all of their capital in April ‘22 – as exchange risk and lower yield made the risk/reward no longer worth it.

Now with tri-party agreements and institutional ETF adoption, they are ready for a comeback by partnering with Amphibian Capital

This Institutional Fund Is Managed by a World-Class team

Amphibian Capital & Dunamis Trading

The Largest Market Neutral Crypto Fund in 2021

Dunamis managed $250M+ aum at the end of ‘21 and returned investors all of their capital in April ‘22 – as exchange risk and lower yield made the risk/reward no longer worth it.

Now with tri-party agreements and institutional ETF adoption, they are ready for a comeback by partnering with Amphibian Capital.

Introducing a Few of

our Team Members

MANAGING PARTNER &

CO-FOUNDER

Multiple Founder & Crypto Influencer. Finance @ UC Berkeley, in Crypto since ‘13. Helped Scale Fintech start-up MX.com from 2-28M users.

Chairman and General Partner, Institutional Fund

Former CIO Fixed Income at Blackrock. Managed $3T+. One of the early Pioneers of ETFs. Illustrious career including PhD, Professor. 24 straight positive quarters when we lead a fund of funds.

CIO - Institutional Fund

Experienced Managing Partner with 28+ years of experience in Equity Trading and Managing Partner at Dunamis Trading Group ($250M AUM) and managed $50B+ at HSBC.

COO, FORMER GLOBAL EQUITIES EXECUTION SERVICES COO, HSBC

20+ years in global investment banking and crypto hedge funds, specializing in equities, crypto execution technology, operations, risk, and compliance

CFP(R) GENERAL PARTNER

& CO-FOUNDER

6+ years at Merrill Lynch, Runs $100M+ AUM Private Weath Management Practice, Crypto Investor since ‘14.

Data scientist with a PhD from the Norwegian University of Science and Technology. His expertise is centered on statistics, data analytics and machine learning, to create quantitative systems and predictive models in financial markets.

Technical background in data science, financial engineering specialist by Universidade de São Paulo, databases skills, taxes specialist, hardware, firmware and software development.

Master’s in Engineering, Expert in Arbitrage, Quantitative Trading, and High-Frequency Strategies. Proven Track Record in Risk Management and Algorithm Development

Crypto Trader Since 2018, Portfolio Manager Specializing in High-Frequency and Quantitative Strategies, Managed $1B Portfolio with $8B Monthly Trading Volume

How We Target Potential Alpha

Rigorous Manager

Selection

Proprietary Portfolio

Optimization

Robust Infrastructure

& Risk Controls

Ongoing Rebalancing

& Manager Testing

Rigorous Manager

Selection

Ongoing Rebalancing

& Manager Testing

Advanced Portfolio

Construction

Active Risk Management

01. Rigorous Manager Selection

We meticulously review 700+ managers and curate a portfolio of the top 15-20, ensuring diverse,

high-performing strategies that fit within our broader investment thesis.

DEEP PORTFOLIO SELECTION PROCESS

Amphibian Capital Fund Selection Details

01

PROPRIETARY SCORING SYSTEM

Our scoring system ranks our top 50 funds based on past performance, max drawdown, risk (sharpe ratio), % of winning months, size, liquidity etc. This comparison gives our investment selection team the data to discuss qualitative factors and create a proposed portfolio, before a deeper vetting process.

02

110 POINT INTEGRITY CHECKLIST

Our 110 point integrity checklist is the first stage of vetting. We have 85 questions to test each fund’s risk policies across security, technical, counterparty, stablecoins and other critical procedural points. We also review their trading strategies, portfolio exposure per trade, internal systems, track record, team, fund terms, operational procedures, etc.

03

SECURITY, RISK MANAGEMENT & TRADING INTERVIEWS

After stages 1 and 2, the final selection process is deep calls between our team and the underlying funds. We are not only reviewing their integrity checklist, but ensuring they can continue to deliver on past performance, we have immense trust with them and their trading strategies continue to be sustainable.

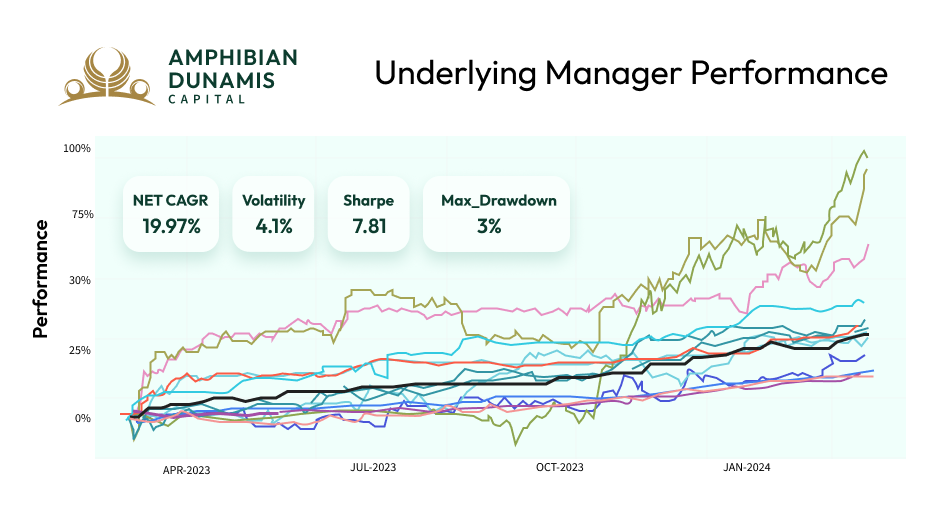

02. Advanced Portfolio Construction

Using our proprietary Markowitz algorithm, we run over 10,000 simulations based on daily P&L data to construct an optimized, risk-adjusted portfolio designed to outperform across varying market conditions.

Our initial recommended SMA allocation uses the Sharpe ratio as the optimization parameter for the Markowitz Model;

The chosen number os SMAs is 15;

Targeted metrics:

- NET CAGR: 19.97%

- Vol: 4.1%

- Sharpe: 7.81

- Max Drawdown: 3%

- Strategy

- Delta neutral

- Market neutral

- Directional Long/short

- % total allocation

- 47%

- 40%

- 13%

Review our Performance Here:

03. Active Risk Management

Our Approach To Risk Management.

Our ideal risk-managed infrastructure is set up with off-exchange settlement, where all managers exclusively

trade within our secure system, ensuring operational integrity and minimizing counterparty risks.

Managers undergo an in-depth vetting process, including performance analysis, risk assessments, and compliance checks before being fully integrated into our infrastructure.

Trading Platform

All trading activity is conducted exclusively within our closed, highly secure system. This structure limits exposure to external platforms, ensuring total control over the trading environment and eliminating external vulnerabilities.

Internal Settlement

Our infrastructure facilitates internal, off-exchange settlement for all trades, eliminating exposure to third-party clearinghouses and mitigating counterparty and settlement risks.

Risk Analytics

We continuously aggregate trade data in real-time, offering advanced risk metrics and performance insights. This enables proactive adjustments to strategies based on real-time volatility and market conditions.

Sophisticated, automated risk management tools monitor every trade against predefined risk limits. Our system actively enforces compliance, flagging trades that approach risk thresholds for real-time intervention.

Our streamlined infrastructure allows for seamless trade execution and internal clearing, coupled with detailed, transparent reporting to ensure all trades meet the highest standards of operational integrity and regulatory compliance.

Managers undergo an in-depth vetting process, including performance analysis, risk assessments, and compliance checks before being fully integrated into our infrastructure.

Our streamlined infrastructure allows for seamless trade execution and internal clearing, coupled with detailed, transparent reporting to ensure all trades meet the highest standards of operational integrity and regulatory compliance.

Sophisticated, automated risk management tools monitor every trade against predefined risk limits. Our system actively enforces compliance, flagging trades that approach risk thresholds for real-time intervention.

All trading activity is conducted exclusively within our closed, highly secure system. This structure limits exposure to external platforms, ensuring total control over the trading environment and eliminating external vulnerabilities.

Our infrastructure facilitates internal, off-exchange settlement for all trades, eliminating exposure to third-party clearinghouses and mitigating counterparty and settlement risks.

We continuously aggregate trade data in real-time, offering advanced risk metrics and performance insights. This enables proactive adjustments to strategies based on real-time volatility and market conditions.

Review our Performance Here:

04. Ongoing Rebalancing & Manager Testing

We have meticulously reviewed 700+ managers and curated a portfolio of the top 15-20, ensuring diverse,

high-performing strategies that fit within our broader investment thesis.

Where Power Meets Adaptability.

At Amphibian Dunamis Capital, we view rebalancing as a dynamic, ongoing process rather than a static event. By continuously evaluating new managers and investment strategies, we proactively adapt to shifts in market conditions and emerging opportunities.

Our rigorous testing protocols assess each new manager’s performance across a range of scenarios, including stress tests and volatility simulations. This ensures that only the most robust strategies are integrated into the portfolio.

We refine allocations in real-time, optimizing risk-adjusted returns and maintaining a flexible, yet resilient portfolio structure. This balance between adaptability and strength is key to driving consistent alpha, even in volatile or uncertain market environments.

A Powerful Blend of Agility and Strength:

Amphibian Dunamis Capital

Why This Merger Matters:

Building a Resilient and Adaptive Investment Partner

Amphibian Dunamis Capital symbolizes the seamless union of two firms committed to exceptional investment performance. By combining Amphibian Capital’s adaptability with Dunamis Trading Group’s strategic power, we forge a partnership designed to thrive in even the most challenging market conditions.

Amphibian Dunamis Capital symbolizes the seamless union of two firms committed to exceptional investment performance. By combining Amphibian Capital’s adaptability with Dunamis Trading Group’s strategic power, we forge a partnership designed to thrive in even the most challenging market conditions.

Dunamis embodies strength and potential, drawing from its Greek origins and the symbolism of the Griffin, a mythical creature representing protection and vigilance. This reflects our commitment to proactive risk management and strategic foresight, enabling us to seize opportunities while safeguarding assets.

The Benefits for You

Amphibian Dunamis Capital offers a unique blend of flexibility and strength,

capable of handling the complexities of modern financial markets.

Amphibian Capital will focus on investor relations, client engagement, marketing, and product innovation, while Dunamis will lead on risk management, technology, trading, manager vetting, due diligence, operations, back office, and finance. Together, we are committed to being a proactive and reliable partner in your investment journey.

Review our Performance Here:

Amphibian Dunamis Capital

A Rare Opportunity For Investors

2% of Digital Assets Hedge-Funds Meet Our Criteria.

We Invest in Strategies Most Don’t Have Access To.

Recapping Amphibian Dunamis Capital

ATTRACTIVE

RETURNS & IMPACT

- Consistent potential yield across ETH, BTC or USD funds.

- 6% soft hurdle rate

- A % of GP profits go to impact-driven projects.

SYSTEMATIC

APPROACH

-

Fully vetted by our team with experience managing $50B+ AUM and

combined 30+ years digital assets/100+ years finance experience.

ONE SIMPLE

TRANSACTION

- Diversified across 15-20+ funds

- Consistent potential returns with 60-day liquidity after initial lock-up.

- Monthly reporting & Annual Tax reports.

*Pro forma performance, representing the average annualized performance from January 2019 through July 2022, net of all fees, for the portfolio of underlying funds that Amphibian Fund invested in beginning on July 1 2022, if the same portfolio had been fully invested as of January 2019 with no rebalancing. Please note each fund was added to the portfolio at a different time, and beginning on July 1, 2022 actual net fund performance is included. All underlying fund performance has been included from the date each fund was added to the portfolio.

What Our Current Lps Are

Saying About Amphibian Capital

There’s a level of consistency and repeatability that shows they have strong manager selection skills

“I’m an investor in Amphibian because I believe they’re the best crypto quant fund of funds. The return on my ETH has far exceeded my expectations, and there’s a level of consistency and repeatability that shows they have strong manager selection skills. This is a fund that operates with discipline and the foresight needed in digital assets.”

Joey Krug

Partner at Founders Fund Former Co-CIO Pantera Capital

I feel more informed and better positioned for long-term gains

I had moved a substantial part of my portfolio from tech stocks into the ETH fund of funds, just before the FTX chaos hit. The risk and volatility in late 2022 were beyond anything I’d faced, but Amphibian's team was ready. Todd and James calmed my nerves with clear, frequent updates and even personal conversations. Now, I feel more informed and better positioned for long-term gains, thanks to their unique strategy and seasoned leadership.

James Workman

Founder AquaShares Inc.

Their diligence in analyzing our trades and strategy is both thorough and highly specific.

"I’ve had the pleasure of working with Amphibian Capital for nearly three years. Their diligence in analyzing our trades and strategy is both thorough and highly specific. They possess a deep understanding of various risk types and the corresponding expected returns. Amphibian Capital stands out as the most sophisticated and knowledgeable fund of funds I’ve encountered in this industry.""

Hugo Xavier

Co-Founder and Head of Trading K2 Trading Partners

Consistently deliver results with a disciplined approach

“We’ve seen James and his team at Amphibian consistently deliver results with a disciplined approach. Our confidence as experienced allocators is unwavering.”

Bendik Loevaas

CEO Jigeum Capital

Highly skilled and genuinely focused on aligning with their investors’ goals

"I have a lot of confidence in Amphibian Capital's team and their thoughtful, steady approach to navigating the volatile world we live in. Their performance has been stellar since I invested. What I value the most is the trust I’ve built with their leadership. The team is highly skilled and genuinely focused on aligning with their investors’ goals. I feel like a true partner in their journey, which has been a meaningful experience and most importantly we are all aligned in having pure intention of giving back via donating a large proportion of profits to worthwhile causes."

Ben Arbib

Founder Nurture Brands

The balance between risk and performance is well articulated and transparent

"I have been very pleased with the consistent performance of the funds I am invested in and the professionalism of team at Amphibian Capital. The balance between risk and performance is well articulated and transparent and the founders have always been generous with their time to provide market insight and answer questions. Whilst the BTC and ETC funds don’t have a long track record, I wouldn’t hesitate to recommend Amphibian Capital to friends and colleagues due to reasons aforementioned, including reliability."